does tennessee have estate or inheritance tax

Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013. This is great news for residence.

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

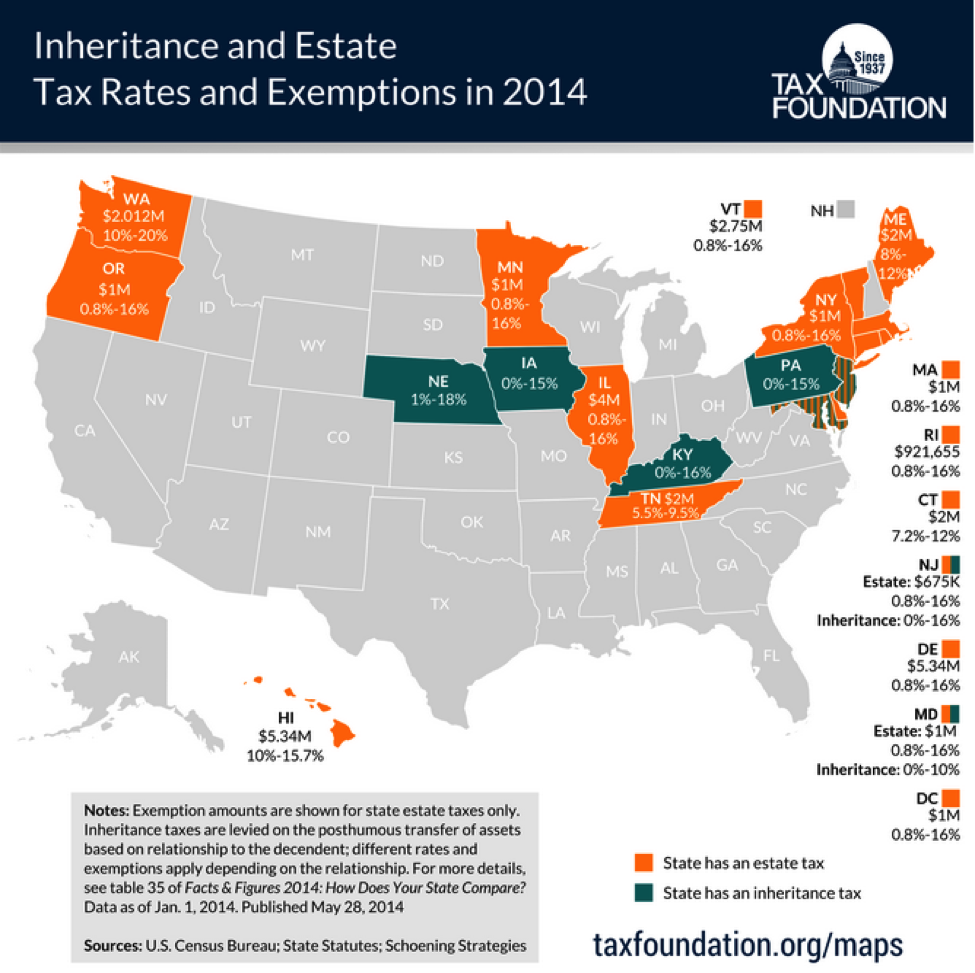

Other states have estate and inheritance taxes ranging from 10 to 16.

. Until this estate tax is. Those who handle your estate following your death though do have some other tax returns to take care. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Inheritance Tax in Tennessee. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. Tennessee is an inheritance tax and estate tax-free state. It is one of 38 states with no estate tax.

Tennessee is an inheritance tax and estate tax-free state. Tennessee is not impose an estate tax. Tennessees tax on alcoholic beverages is 440 per gallon of spirits and 121 per gallon of wine.

Tennessee does not have an estate tax. Connecticut has the highest tax exemption level at 91 million while Oregon and. The exemption is 117.

There are NO Tennessee Inheritance Tax. Do Tennessee residents have to worry about an inheritance tax. Tennessee estate tax.

Today Virginia no longer has an estate tax or inheritance tax. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state. In fact it doesnt matter the size of your estate there will be no state level.

Iowa is phasing out its. The top estate tax rate is 16. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies.

Estate and Inheritance Taxes. Tennessee is an inheritance tax-free state. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. Tennessee has no inheritance tax and its estate tax expired in 2016. However there are additional tax returns that heirs and.

How Do State And Local Sales Taxes Work Tax Policy Center

Illinois Should Repeal The Death Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Does Kansas Charge An Inheritance Tax

Big News For 2012 Tennessee Repeals Gift Phases Out Inheritance Tax Elder Law Of East Tennessee

An Inheritance Tax Overview Any Generation Can Understand Taxry

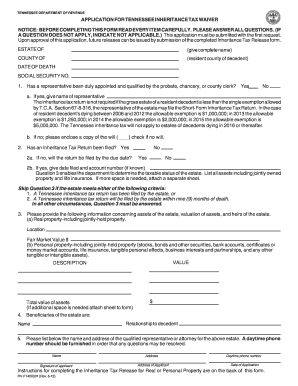

Fill In State Inheritance Tax Return Short Form

An Overview Of Tennessee Trust Law

States With No Estate Or Inheritance Taxes

State Estate And Inheritance Taxes Itep

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tennessee Inheritance Laws What You Should Know Smartasset

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)